So you’ve been using your leased solar system to generate your clean energy for a few years, but you’re thinking about selling your house.

What will happen with your PPA? Is it possible to get out of the contract?

What exactly is a Power Purchase Agreement (PPA)

It is a standard method of financing solar projects with contracts from 20 to 25 years between a consumer and a solar developer, usually an EPC.

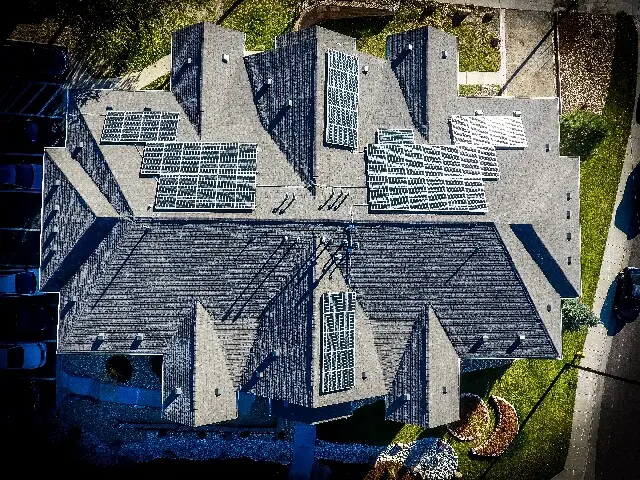

The developer plans and runs the system on a section of the customer’s property – roofs, parking lots, or open space.

The developer then offers the client the electricity generated by the solar installation at a lower price than they would have paid the utility for the same energy.

Is It Possible to Buy Out of a Solar PPA?

Most PPA agreements include buyout options, which allow you to pay for the system entirely before the contract expires.

You’ll typically see the option to buy out in PPA agreements.

However, all the possibilities from the number of years to the buyout are not the same on every contract.

Due to constraints on the federal tax incentives used by PPA financing organizations, buyouts of PPA agreements are often not available until the seventh year of the contract.

It means that buying out of a PPA is better for some people than it is for others.

Why Buy-Out of PPA?

The primary motivation for purchasing a PPA is to save money.

Numerous PPA contracts provide the opportunity to buy out.

It gives you an affordable early purchase alternative between the seventh and tenth year of the contract to allow transfer of ownership to the customer after the financing partners have taken advantage of federal tax benefits.

Customers in California who enrolled in PPA agreements between 2007 and 2013 to take advantage of the California Solar Initiative (CSI) program’s monetary incentives during the first five years of operation are another prominent example.

Some earlier PPAs featured relatively high base energy rates and high annual rates up to six percent.

Due to both the 2008 economic crisis and the introduction of “fracking,” which badly cut the cost of natural gas—a vital fuel for electrical power plants—utility energy costs have remained relatively stable during this period.

Many of these customers found out that they are paying as much or higher for energy under their PPA contract than if they got their electricity from the local utility company.

It happens when the CSI incentives for the projects they joined run out after the fifth year.

It also occurs because utility energy costs remain stable instead of increasing the way they expected it to happen.

How Do You Know if a PPA Buyout is For You?

If you believe you can save money by buying out your PPA agreement, a detailed analysis of the agreement and the project’s financial performance is required.

We suggest doing the following to see if a buyout is right for your project:

- Examine your PPA contract and look for buyout and termination options, as well as a schedule of values for each.

- Think about and understand the many funding opportunities to help you get out of the contract.

- Try to look for and understand the types of costs and danger that come with owning and taking care of a solar facility. That includes: how they function, maintaining them, insurance, decommissioning, and financial management.

- Most PPA agreements stipulate that the buyout price be at least Fair Market Value (FMV), which may need an IRS-mandated FMV assessment.

- Calculate the current electrical energy all-in cost, the sum of PPA, and residual utility energy costs.

Accounting for possible utility tariff restructuring, long-term energy market trends, system performance deterioration, and other ownership costs through careful financial and performance modeling.

Why Should You Buy Out Your Solar Lease?

If you’re going to sell your home soon, buying out your lease can increase the value by thousands of dollars.

Rather than waiting until your lease expires or keeping the rented panels on your roof, the increased value of your home can easily outweigh the expense of paying off your loan.

If your buyout cost is seven thousand dollars, for example, your system might add more than that to the value of your property, making it a practical and financially sound choice.

Remember that rented solar systems don’t add much value to your property.

While some solar businesses claim that lease changes are straightforward, they can still be a hassle.

Some individuals dislike the concept of taking over a solar lease when purchasing a home, which could make your home more difficult to sell.

The Bottom Line

It’s possible that buying out your lease will be less expensive than your monthly payments.

It varies by scenario, but some of the calculations we’ve seen show monthly payments of nearly fourteen thousand dollars versus a seven thousand dollars buyout fee.

If your buyout amount is smaller than your monthly payment, this option will save you money in the long term.